USD Coin (USDC)

USD Coin (USDC) is a stablecoin pegged to the US dollar and redeemable on a 1:1 basis for US dollars, backed by dollar-denominated assets held in segregated accounts with US-regulated financial institutions.

Benefits of USDC

Fiat-backed stablecoins (cryptocurrencies pegged to reserve assets like the U.S. dollar) provide customers stability and confidence during times of volatility. USDC is one of the most trusted and reputable digital dollars, fully backed with high-quality reserves.

- High quality reserves: USDC is 100% backed by cash and short-dated U.S. Treasuries held in regulated U.S. financial institutions.

- Transparency: A third-party accounting firm conducts transparent, monthly attestations on the US dollar-denominated reserves that back the USDC in circulation.

- Stable store of value: The value of your USDC is preserved over time whether you want to pay, send, or trade. USDC is designed to be pegged to the US dollar and redeemable 1:1 for USD.

- Rewards: Users in eligible regions may be able to earn rewards on their USDC simply by holding it in their Coinbase account.

Where can start learning about USDC?

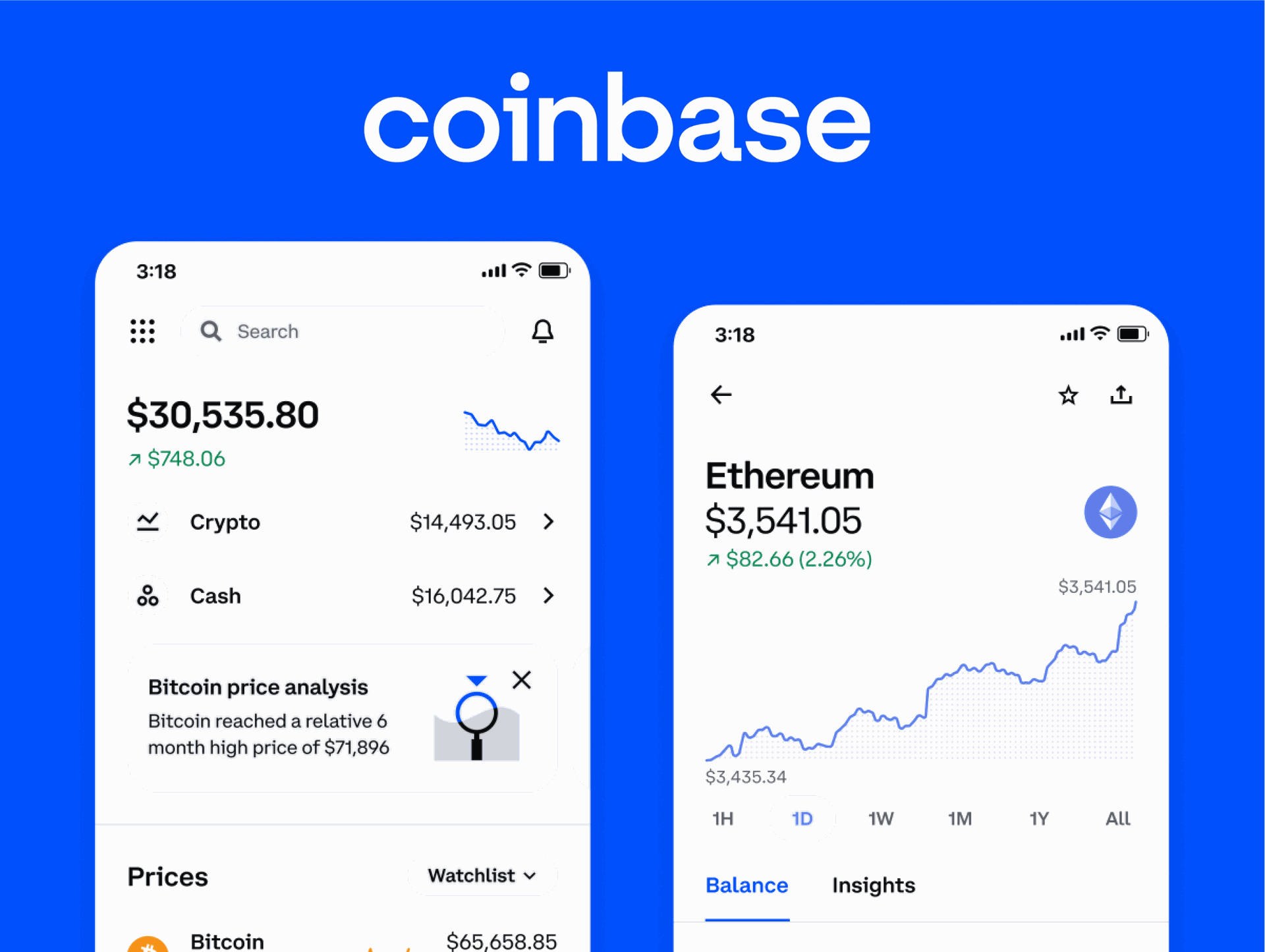

Coinbase is a publicly traded American cryptocurrency exchange that provides a platform for buying, selling, and storing digital assets. Founded in 2012, it has grown to become one of the largest and most widely used exchanges globally, especially for beginners. The company offers a variety of products for both individual users and institutional investors. Core business and mission

- Mission: Coinbase's stated mission is to "create an open financial system for the world" by making cryptocurrencies and the broader crypto economy accessible to everyone.

- Target audience: The platform is considered a user-friendly entry point into the crypto market for novices, but it also provides more advanced trading tools for experienced traders.

- Regulatory approach: Compared to some of its competitors, Coinbase has a reputation for being more conservative and compliant with regulations in the countries where it operates.

Key products and services

- Coinbase platform: A secure online platform and mobile app for buying, selling, storing, and transferring hundreds of different cryptocurrencies, including popular ones like Bitcoin (BTC) and Ethereum (ETH).

- Coinbase Advanced: A trading platform for more experienced users that offers lower fees and features like real-time market data, advanced charting, and order books.

- Coinbase Wallet: A separate, non-custodial crypto wallet that allows users to have full control of their private keys and interact with decentralized applications (dapps).

- Coinbase One: A subscription service that offers premium features such as zero trading fees on certain transactions and boosted rewards.

- Coinbase Prime: A dedicated platform for institutional clients, such as asset managers and banks, to invest in digital assets.

- Coinbase Card: A Visa debit card that allows customers to spend their cryptocurrency holdings.

Corporate background and history

- Founders: Brian Armstrong and Fred Ehrsam founded the company in 2012.

- Remote-first culture: In 2020, the company transitioned to a remote-first work environment, though it did re-open an office in San Francisco in 2025.

- Public listing: Coinbase went public on the Nasdaq exchange via a direct listing on April 14, 2021.

- S&P 500 inclusion: On May 19, 2025, Coinbase was added to the S&P 500 index.

Security and compliance

- Security measures: Coinbase implements high-level security protocols, including two-factor authentication (2FA), biometric logins, and using offline "cold storage" for the majority of customer funds.

- Regulatory focus: The company has historically emphasized regulatory compliance, requiring users to provide identification and reporting transaction information to the Internal Revenue Service (IRS).

- Legal challenges: Coinbase has had legal issues, most notably a lawsuit from the U.S. Securities and Exchange Commission (SEC) in 2023. The SEC dismissed the case in February 2025.

- Cyberattacks: The company has been the target of cyberattacks and extortion attempts. After a May 2025 incident, it pledged to reimburse customers up to $400 million.